Cryptocurrency

At the G20 conference, a significant decision regarding cryptocurrencies was made, which may impact crypto market!.

Cryptocurrency

Falcon, a blockchain project by NPCI, will expand India’s payments market

-

AI2 years ago

AI2 years agoRevolutionizing Road Safety: How AI Can Save Lifes and Prevent Vehicle Collisions

-

Blog2 years ago

Blog2 years agoUnveiling the Wonders of the Andromeda Galaxy!!

-

AI2 years ago

AI2 years agoQuantum Computing and AI: The Mind-Blowing Revolution That Will Change EVERYTHING!

-

SpaceX2 years ago

SpaceX2 years agoThe “Dear Moon” Project by SpaceX: Breakthrough Lunar Tourism

-

Space2 years ago

Space2 years agoDeep Space Network: How Do We Communicate with Faraway Spacecraft?

-

NASA2 years ago

NASA2 years agoJames Webb Space Telescope Could Soon Discover Alien Life, Scientists Claimed!

-

Cryptocurrency2 years ago

Cryptocurrency2 years agoFalcon, a blockchain project by NPCI, will expand India’s payments market

-

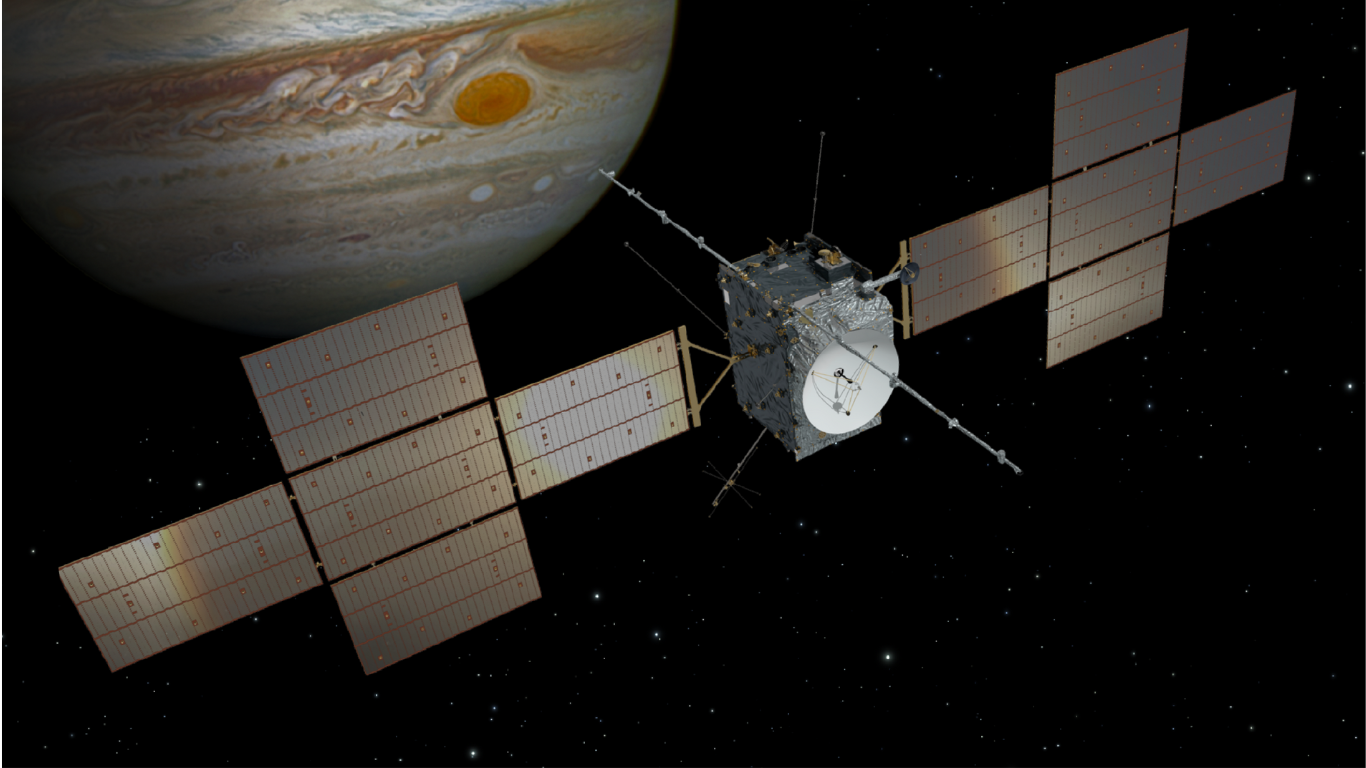

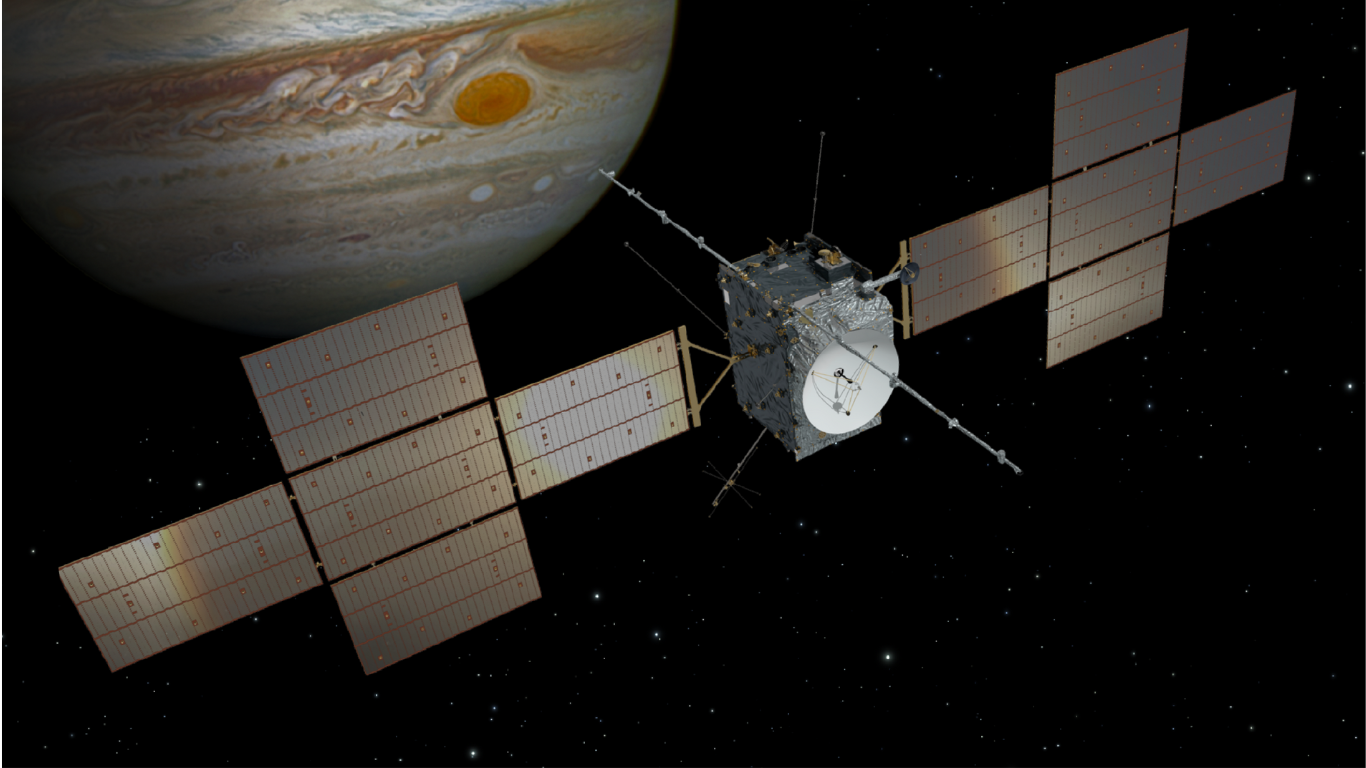

Space2 years ago

Space2 years agoExploring Jupiter’s Icy Moons: ESA’s Juice(Jupiter Icy Moons Explorer) Mission